TOP GLOVE POSTS LOWER 1Q NET PROFIT OF RM185.71MIL, SEES CHALLENGING OUTLOOK

10 December 2021 / 12:12

THE STAR

KUALA LUMPUR: Top Glove Corp Bhd, which posted a net profit of RM185.71mil in the first quarter ended Nov 30, 2021 (1Q22) has declared a dividend payment of 1.2 sen per ordinary share.

The dividend payment amounted to RM96mil. The ex date for the dividend is Dec 24, 2021 while the payment date is Jan 10, 2022.

Revenue in the first quarter fell to RM1.58bil from RM4.76bil a year prior. Its net profit during the quarter was significantly lower compared with RM2.35bil a year ago.

Top Glove’s net cash position as at Nov 30, 31 stood at RM1.06bil.

The group said the softer performance was mainly attributed to normalising average selling prices (ASPs) and glove demand following mass vaccine rollout on a global scale, while customers remained cautious on replenishing orders.

In addition, Top Glove said raw material costs reduced at a much slower pace in comparison to glove ASPs, thereby impacting its profit.

However, the glove manufacturer said the surplus in glove supply would likely be offset in part, by the steady and consistent growth in global glove demand.

“Glove demand, which continues to be driven by strong market fundamentals, was already growing at a rate of 10% yearly pre-Covid and is expected to increase further even after the pandemic recedes, on the back of heightened glove usage and hygiene awareness.

“In addition, the group is gradually regaining its exports from Malaysia to the US, which is expected to improve sales volume in the quarters to come,” it said.

Top Glove said raw material prices are on a downtrend quarter on quarter, with average natural latex concentrate prices weakening by 8% to RM5.09 per kg.

Meanwhile, nitrile latex prices decreased by 19% to US%1.79 per kg and are expected to continue declining at a much higher percentage going forward.

Managing director Datuk Lee Kim Meow said: “The team’s efforts to deliver these results against a challenging environment with headwinds, are to be commended.”

“Having been in the glove industry for 30 years, we know this is part of the business cycle and have prepared for it.

“We have built up our reserves over the last two years which will enable us to go through leaner times and leverage any M&A opportunities which may arise,” he said.

“While times may be tough now, we are confident good times will come again. We believe even in the hardest of times, there is also opportunity, as long as we continue to stay healthy and maintain a positive expectation of the future,” Lee said.

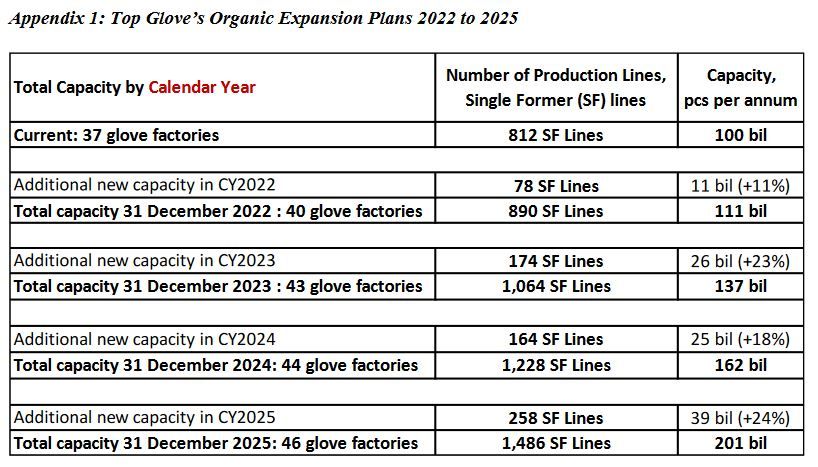

In light of the challenging business landscape, Top Glove will be cautious and defer its expansion plans to be in line with market trends and the demand-supply situation.

“The group’s growth strategy will include a combination of organic expansion, inorganic expansion and strategic investments.

“By Dec 31, 2025, Top Glove is projected to have a total of 59 factories comprising 46 glove factories and 13 other factories, 1,486 glove production lines and a glove production capacity of 201 billion gloves per annum,” Top Glove said.

On its outlook, Top Glove expects the business environment will be challenging in the immediate term, as competition continues to intensify amidst moderating glove demand.

“Nonetheless, the company remains cautiously optimistic on its industry outlook, given that global demand for gloves as an essential item will continue to grow steadily at a rate of more than 10% per annum even after the pandemic recedes,” it said.

.jpg)

.png)

.png)

.png)

.png)

.png)