GLOVE SHARES AT ALL-TIME HIGHS ON STRONG EARNINGS

20 December 2017 / 12:12

PETALING JAYA: Major rubber glove manufacturers on Bursa Malaysia saw their share prices shoot up to all-time highs yesterday, driven by stellar earnings results from Top Glove Corp Bhd.

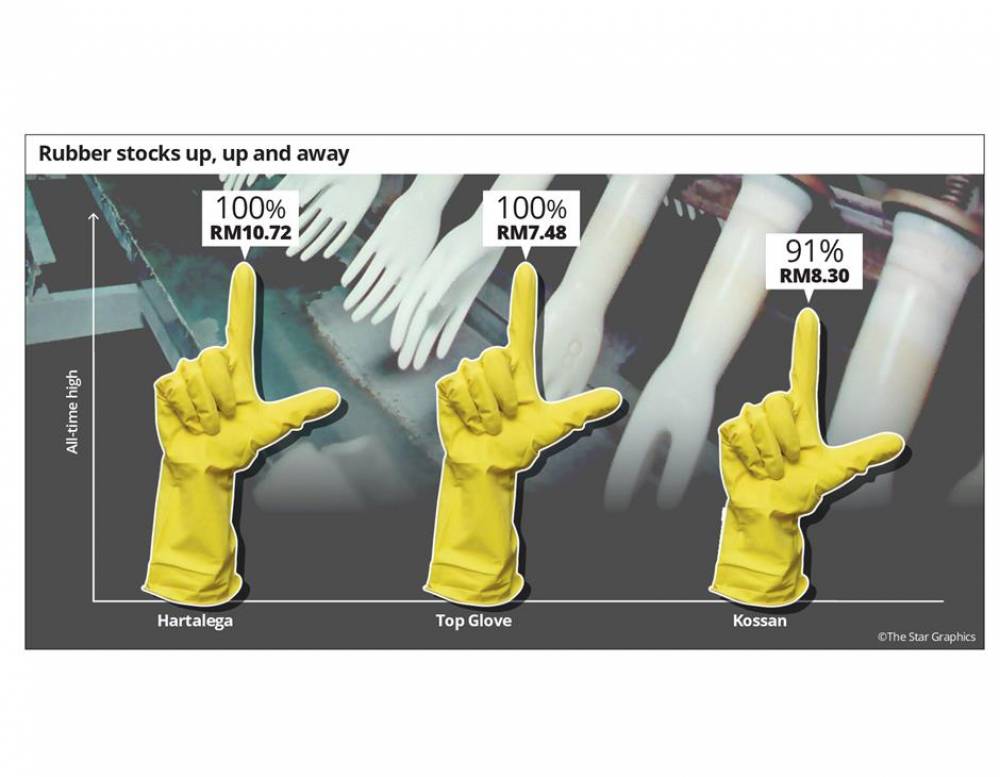

Shares in Top Glove, the world’s largest glove manufacturer, gained 54 sen to close at a record high of RM7.48 apiece, with 7.6 million shares changing hands.

The optimism on Top Glove also fired up investor appetite for other major glove makers, namely, Hartalega Holdings Bhd and Kossan Rubber Industries Bhd.

At yesterday’s close, Hartalega’s share price soared 68 sen to an all-time high of RM10.72, while Kossan added 34 sen to RM8.30, the highest since January 2016.

Hartalega saw its net profit for the second quarter ended Sept 30 rose 59% to RM113.3mil driven by higher sales and improvements to its productivity. Its revenue for the quarter was 33.8% higher year-on-year at RM584.6mil.

In recent months, the earnings of the glove manufacturers have been boosted by the reduced supply of vinyl gloves from China in the republic’s efforts to counter polluting industries.

According to Malaysian Rubber Glove Manufacturers Association president Denis Low Jau Foo in October, the total export value of rubber gloves from Malaysia is expected to increase by RM3bil this year to RM16.2bil. This is despite the fact that local glove makers face escalating cost pressures from natural gas, raw materials and labour costs.

Low also said the growth could be sustained and perhaps improved further mainly due to the closure of some vinyl factories in China.

China produces about 160 billion pieces of vinyl gloves per year.

Low said the usual growth in terms of quantity of exported gloves has always been 8% to 10%, but this figure has moved up to 15.8% in the first half of 2017.

In a filing with Bursa Malaysia yesterday, Top Glove said it had posted a 44% surge in net profit to RM105.5mil for the first quarter ended Nov 30 from RM73.3mil a year earlier, driven by new capacities and strong demand.

It saw a record revenue of RM938.1mil during the quarter, a 19% jump from RM785.58mil last year.

“The excellent set of numbers was driven by strong demand from both developed and emerging markets,” it said.

Top Glove said that demand increased further due to the disruption in the vinyl glove supply, following China’s strict enforcement against polluting industries, which benefited both natural rubber and nitrile glove sales.

“Internally, new capacity is coming onstream, and continuous improvement initiatives in terms of automation, better production lines and cost-savings were also instrumental in contributing to the strong performance,” the group said.

Top Glove chairman Tan Sri Lim Wee Chai credited the group’s consistent performance to its ongoing initiatives in enhancing its manufacturing processes.

To further drive the group’s growth, he pointed out that Top Glove would expand its operations that consist of more production lines next year.

“We will continue to build one to two factories every year, and the current plan for next year includes the construction of two new manufacturing facilities, namely, Factory 31 (operational by May 2018) and Factory 32 (operational by December 2018),” he said.

“Upon completion, this will boost the group’s total number of production lines by an additional 78 lines and production capacity by 7.8 billion gloves per annum,” Lim added.

On Top Glove’s condom manufacturing facility, the group expects operations to commence by June next year.

“Towards expanding more expeditiously and efficiently, Top Glove will also continue to explore mergers and acquisitions, as well as new set-ups in synergistic industries,” Lim said.

Analysts said improving demand and rising average selling prices have set the stage for earnings in the rubber glove sector to recover after three consecutive quarters of sluggish growth.

The growth of rubber glove makers is no longer heavily influenced by the currency exchange rate, they added.

According to PublicInvest, the glove manufacturing industry’s expansion was timely, with the demand growth of nitrile offerings and more specific product types.

“Escalating costs, however, remain a pressure, although the major glove players are relatively immune by now, and have continuously adopted efficiency initiatives to tackle potential fluctuations in natural gas hikes and labour costs.

“But these were offset by the sustained demand growth and penetration into untapped markets,” it said in a report recently.

However, the research house remains “neutral” on the sector as the market has “already priced in” the growth. “With recent hikes in the gas tariff, there is some time lag of the cost-pass through in the first half of 2018,” it added.

.jpg)

.png)

.png)

.png)

.png)

.png)