STILL SCREAMING BUY FOR TOP GLOVE AS IT PREPARES FOR MORE BUMPER RESULTS

12 June 2020 / 12:06

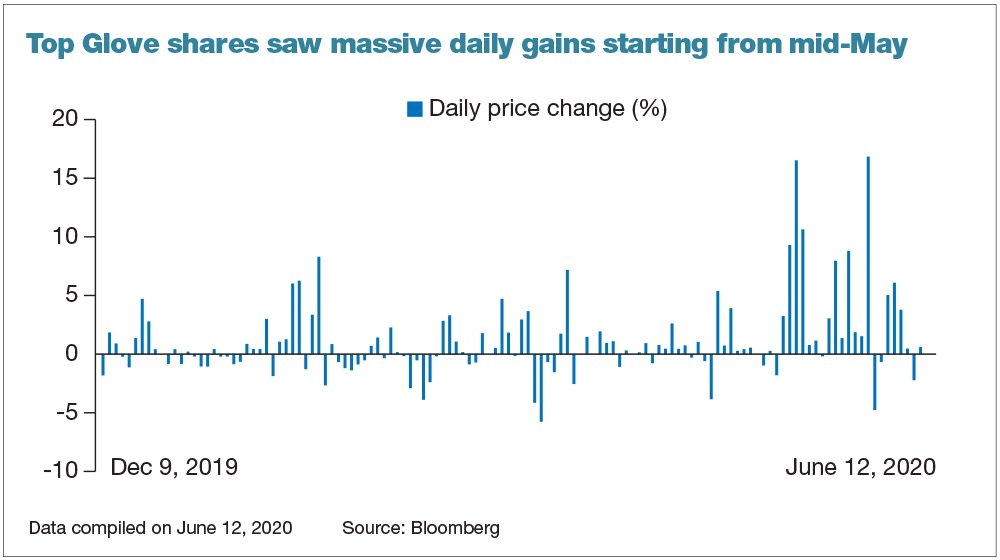

KUALA LUMPUR (June 12): Being one of the world’s best performing benchmark index component stocks thus far and even after more than tripling its share price since the beginning of this year, Top Glove Corp Bhd remains as the favourite among research firms.

Poised for a record-breaking financial year ending Aug 31, 2020 (FY20), after the quantum leap in earnings seen in Top Glove’s third quarter ended May 31, 2020 (3QFY20), three-quarters of the analysts covering the counter are screaming “buy” calls.

According to Bloomberg, out of the 20 analysts covering the stock, half of them have target prices of RM20 and above, with the highest at RM25 from CGS-CIMB Research and Kenanga Research. This would also imply a 49% headroom from the current share price.

While global markets are experiencing a second wave of global rout after the dovish comment from the US Federal Reserve, shares of Top Glove remain steady and were up 12 sen or 0.72% at RM16.82 at noon break.

“We continue to like Top Glove as the key beneficiary of the current favourable supply-demand dynamic in the glove sector due to the Covid-19 outbreak, given that it is the world’s largest glove maker by capacity (78.7 billion pieces per annum currently),” said CGS-CIMB Research Walter Aw, in a note yesterday.

Going forward, he expects Top Glove to continue recording sequentially stronger results on a quarterly basis in FY21 on the back of higher glove sales, further increase in average selling prices (ASPs), and better economies of scale.

With the strong global demand for gloves, Top Glove has also been gradually increasing its production capacity and it expects to reach 100.4 billion pieces by the end of FY21.

With the strong global demand for gloves, Top Glove has also been gradually increasing its production capacity and it expects to reach 100.4 billion pieces by the end of FY21.

Furthermore, Top Glove also plans to raise the ASPs by 15% a month in July and August respectively, which would widen its profit margin.

The rubber glove maker’s profit margin swelled to 21% in 3QFY20 versus 6% in the preceding year corresponding quarter.

Some staying cautious, despite being confident of stronger results to come.

Still, as Top Glove's share price has tripled in the last five-and-a-half months, a couple of analysts are turning cautious, despite the stronger earnings outlook, and have downgraded their calls for Top Glove to “hold” as they believe that the positive has already been priced in.

Out of the 20 analysts covering the stock, five have “neutral” ratings on the rubber glove maker.

PublicInvest Research analyst Chua Siu Li, for one, has downgraded the call on Top Glove to “neutral” from “outperform”, with a higher target price of RM19.30 from RM12.70 previously.

“While we do not discount the fact that Top Glove is capable of delivering record-breaking profits, we believe the exceptionally strong results are not sustainable in the long run, hence we deem it is unjustified to continue valuing Top Glove at 43 times price-to-earnings (PE) (+2SD of its five-year historical mean),” said Chua, in a note today.

In that regard, Chua is cutting PE multiple on Top Glove to 31 times (+1SD of its five-year historical mean).

Valuation-wise, Top Glove's trailing 12-month PE stood at 71.88 times — the highest among its peers, according to Bloomberg. It is also very expensive when compared to its five-year average PE of 23.87 times.

Additionally, Chua also highlighted the possible risk of the government imposing windfall tax as the glove industry is one of the very few sectors that benefited significantly from the pandemic outbreak. Previously, the government had imposed a windfall tax on the plantation sector.

Nonetheless, she reckoned that the chances of this happening to the glove sector is low as gloves are predominantly for the export markets and unlike the plantation sector, there is no urgent need to stabilise glove prices in the domestic market.

However, Chua is also adopting a more cautious stance on Top Glove currently, as its share price has rallied circa 180% since an upgrade in end-January. She is of the view that the risk-reward ratio has turned less favourable for investors currently.

HSBC’s Shuo Han Tan, on the other hand, has maintained a “hold” rating with a target price of RM15 — the lowest among the research firms.

.jpg)

.png)

.png)

.png)

.png)

.png)