STRONGER 2Q FOR TOP GLOVE Y-O-Y, SLOWER GROWTH Q-O-Q

15 March 2016 / 12:03

Top Glove Corp Bhd

(March 14, RM5.32)

Maintain buy with a lower target price (TP) of RM7.51: Top Glove Corp Bhd’s upcoming second quarter of financial year 2016 (2QFY16) results will be released tomorrow. On a year-on-year basis, we understand that its 2QFY16 earnings will come in stronger than last year’s RM56.2 million thanks to a stronger US dollar and lower raw material prices. However, on a quarter-on-quarter basis, its 2QFY16 results should see a slowdown in earnings growth from RM128.9 million (which was the record high in history mainly on account of a stronger US dollar) mainly due to the strengthening of the ringgit.

Top Glove’s recent share price retracement was triggered by the reversal in the ringgit trend. The ringgit strengthened against the US dollar from RM4.4 per US dollar on Jan 12, 2016 to RM4.08 per US dollar on March 11, 2016. The company’s core earnings are unlikely to achieve another record high as macro conditions now support a stable and potentially stronger ringgit. Meanwhile, Top Glove’s average selling price (ASP) is expected to continue to decline amid higher installed capacity.

The expansion plans for Factory 27 in Lukut, Port Dickson (commencement by March 2016), Factory 6 in Thailand (commencement by August 2016) as well as the construction of a new facility, Factory 30 (commencement by February 2017) are expected to boost the number of production lines to 540 and capacity to 52 billion gloves per annum by end-FY17 (versus current production lines and capacity of 484 and 44.6 billion respectively

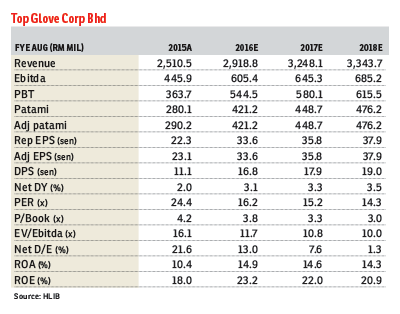

Our FY16 and FY17 core earnings forecasts are lowered by 3% and 5% as we lower our ASP assumption given the low raw material price environment. We note that the strong US dollar catalyst has diminished as the ringgit is poised to maintain its strength given its resilient economic fundamentals. We already trimmed our ringgit assumption to RM3.80 per US dollar in our FY16 and FY17 forecasts (versus RM4 per US dollar previously).

From the valuation perspective, Top Glove is still the most attractive rubber glove stock among those under our coverage. Its positives are the gradual shift to nitrile gloves, China’s operations having turned around, improved production efficiency, cost reduction via product line automation and the SAP ERP (enterprise resource planning software developed by German company SAP SE) system.

Negatives, meanwhile, are that Top Glove will experience lower net profit margins when compared with peers due to lower exposure to nitrile latex gloves and powder-free natural rubber gloves. We maintain “buy” on Top Glove with a lower TP of RM7.51 (from RM8.04) post-earnings forecast adjustments, based on an unchanged price-earnings ratio (PER) of 20.6 times calendar year 2017 earnings per share, +1 standard deviation above its five-year historical average PER. — Hong Leong Investment Bank Research, March 14

The Edge Markets

.jpg)

.png)

.png)

.png)

.png)

.png)