TOP GLOVE PLANS SECONDARY LISTING IN SINGAPORE

15 March 2016 / 12:03

KUALA LUMPUR (NewsRise) -- Malaysia's Top Glove, the world's largest rubber glove maker by volume, is planning a secondary listing on the Singapore Exchange that won't involve issue of fresh shares.

Instead, the company intends to explore with its major shareholders a possibility of selling shares worth about 20 million Singapore dollars ($14.5 million) in the open market of the SGX to create liquidity, Top Glove said in a filing to the Malaysian stock exchange.

The company said a dual listing will improve the "visibility of Top Glove's profile among international investors, analysts and media, thereby potentially resulting in a stronger brand awareness." Foreigners currently own more than 30% of Top Glove's shares.

While the proposed secondary listing is not expected to impact its earnings, analysts and investors viewed the move positively as it would help boost liquidity of Top Glove's shares and allow the company to tap into a wider base of investors for potential fund raising activities in future.

The move will also allow Top Glove to "exercise flexibility in terms of raising funds for both growth and operations in the future," said MIDF Amanah Investment Bank analyst Noor Athila Mohd Razali. "We think the listing will assist in broadening the company's merger and acquisition horizon and boost attractiveness to both potential targets and also future investors."

Top Glove, backed by record profits, resilient demand for its gloves, and swelling cash reserve, has said it was seeking to acquire at least one company a year to stay ahead of the competition. The company's cash and cash-equivalent rose more than three-fold to 469.6 million ringgit at the end of November.

Some analysts however, flagged risks surrounding dual listings.

"Dual-listing is often associated with higher listing costs and more stringent regulatory requirements, which may outweigh the benefits," said Affin Hwang Investment Bank analyst Aaron Kee. However, he kept the stock's Buy rating for "its undemanding valuations and healthy margin expansion."

Maybank Investment Bank's Lee Yen Ling meanwhile noted the likely share sale by its main shareholders would amount to about 1% of the total shares issued and would "not add substantially" to its liquidity.

"Additionally, valuations of the SGX-listed glove players are also below that of Bursa Malaysia-listed glove players," Lee said, "hence, the secondary listing will not boost Top Glove's valuations."

Top Glove currently trades at 19 times its earnings while its smaller Singaporean rivals UG Healthcare Corp and Riverstone Holdings are valued at 18 times and 17 times their earnings respectively.

Top Glove is due to report its financial results for the fiscal second-quarter ended February 29 on Wednesday.

Shares of Top Glove rose as much as 3.6% in Kuala Lumpur trading but ended unchanged at 5.32 ringgit a piece on Tuesday. The benchmark FTSE Bursa Malaysia KLCI was down 0.6%.

The stock has lost about 19% so far this year amid worries that the strengthening ringgit, which has gained nearly 5% against the U.S. dollar since January, would erode profit margins from overseas revenue.

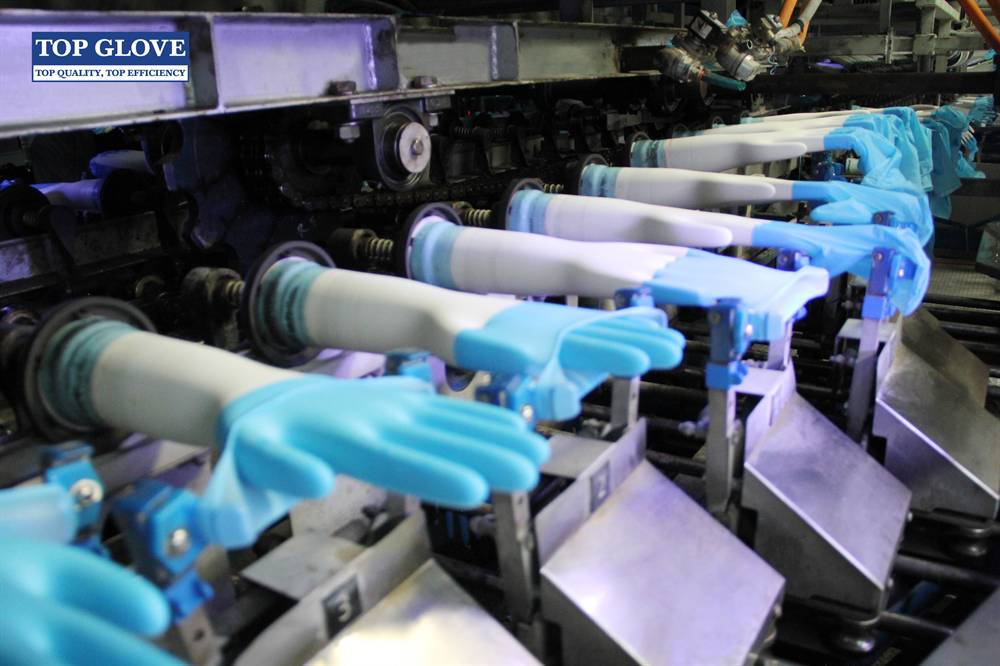

The company, which manufactures about 45 billion pieces of gloves annually, exports nearly 95% of its products.

Nikkei Asia

.jpg)

.png)

.png)

.png)

.png)

.png)