TOP GLOVE REBOUNDS AS ASPION NEWS SOOTHES INVESTORS

11 July 2018 / 12:07

KUALA LUMPUR-Top Glove Corporation holds signing ceremony for the $310 million syndicated credit facilities at 1000 (0200 GMT)

PETALING JAYA: Top Glove Corp Bhd’s share price rebounded 8.4% to RM9.90 yesterday as the market was told that the impact from the irregularities involving the purchase of Aspion Sdn Bhd, one of the largest surgical glove producers globally, would not be hugely detrimental to the company.

Top Glove is taking legal proceedings against Adventa Capital Pte Ltd, the owner of Aspion, due to irregularities uncovered in balance sheet items of Aspion involving the valuation of its inventories, and plant and machinery.

In a response to Bursa Malaysia’s query letter requesting additional information related to the legal proceedings, Top Glove said the interim report by an independent accounting firm found that there was an overstatement of inventory, plant and machinery in Aspion’s accounts amounting to RM74.4mil.

Furthermore, the acquisition price of Aspion had been overstated by RM640.5mil.

“The purchase consideration was based on a price-earnings (PE) multiple of 16.93 times the financial year 2018 (FY18) profit after tax (PAT) target of RM80.9mil.

“However, Top Glove and its wholly owned subsidiary Top Care Sdn Bhd have since discovered that the past profitability used to project the FY18 PAT was misrepresented.

“Thus, such misrepresentation resulted in Top Glove and Top Care agreeing to pay a purchase consideration far higher than they would have had the truth been known to them,” said Top Glove.

The group added that it would proceed with the previously announced proposed bonus issue and proposed bond issue.

One of the vendors, Low Chin Guan, has been relieved from his duties and Top Glove is currently seeking legal advice as to Low’s position as a director in Top Glove.

“The company is engaging with the auditors of Aspion to assess if there is any effect to the audited financial statements of FY16.

“In addition, management is also in the process of reassessing the profits and cash flow projections of Aspion in view of the latest development,” said Top Glove, adding that the financial impact, if any, would be incorporated in the coming fourth-quarter financial results ending Aug 31, 2018.

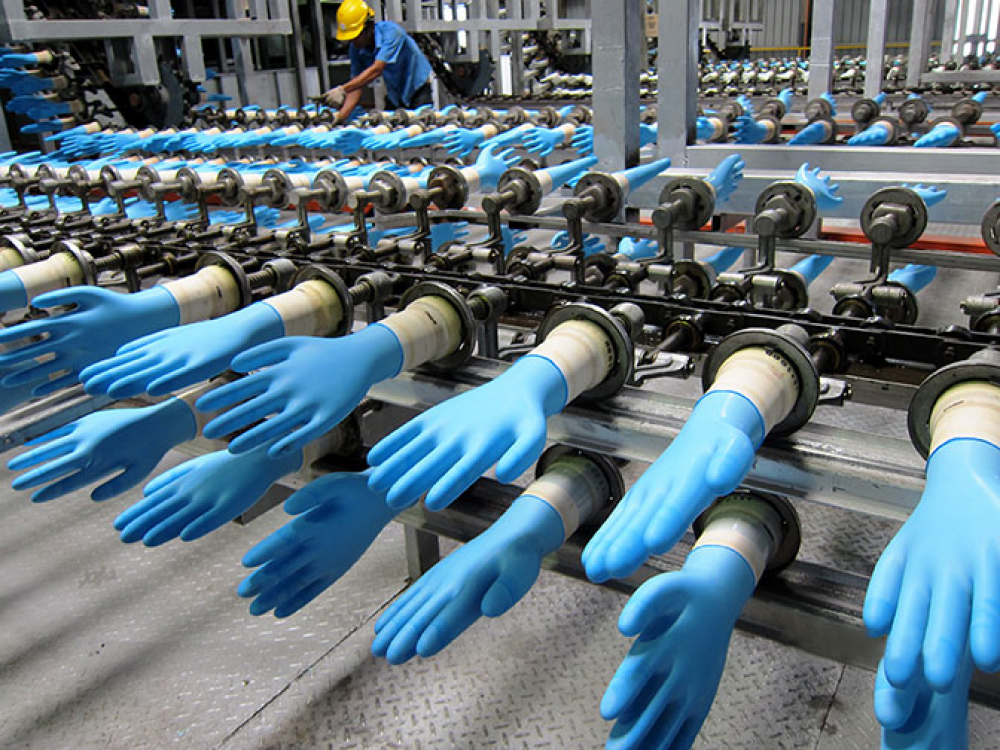

During an analyst briefing held on Monday evening, the management of Top Glove had shared that Aspion’s surgical glove technology was real and other physical assets were in place.

According to UOB KayHian, Aspion is said to be capable of remaining in the black but not at the level of profits as initially promised by the vendors.

“Preliminarily, management is looking at only RM40mil over the next one year but RM80mil is a more realistic target over a two to three-year horizon.

“Also, Top Glove stressed that the existing standalone operation is running business as usual and the group has effectively taken over the role of supervising the day-to-day operations of Aspion,” said UOB KayHian in a research report yesterday.

Kenanga Research expects an impairment charge of RM640.5mil in the worst-case scenario, in the event that Top Glove is unable to recoup the claims made.

The research house said the impairment charge would erode Top Glove’s book value by 28% from RM1.77 per share to RM1.27 per share as at May 31, 2018, and conservatively cut its FY18 and FY19 estimated net profit by 3% and 6% by partially removing the profit guarantees from Aspion.

“We have lowered our target price from RM9.40 to RM8.20 based on 23 times FY19 earnings per share. Apart from lowered earnings, the downgrade in our target price also reflects a lower one-year forward PE ratio of 23 times, from 24.5 times previously to account for concerns over execution risk at Aspion,” said Kenanga Research.

The Star

.jpg)

.png)

.png)

.png)

.png)

.png)