THIS MALAYSIAN STOCK HAS TRIPLED IN PRICE DUE TO THE CORONAVIRUS PANDEMIC. IT COULD CLIMB FURTHER

12 June 2020 / 12:06

Staff of Top Glove, the world’s biggest glove maker, check on the production of latex gloves in a watertight test room at one of the company’s factories in Selangor, Malaysia, on Feb. 18, 2020.

Samsul Said | Bloomberg | Getty Images

The share price of Malaysia’s Top Glove, the world’s largest medical glove maker, has more than tripled this year thanks to the coronavirus pandemic — and analysts said the stock could still climb higher.

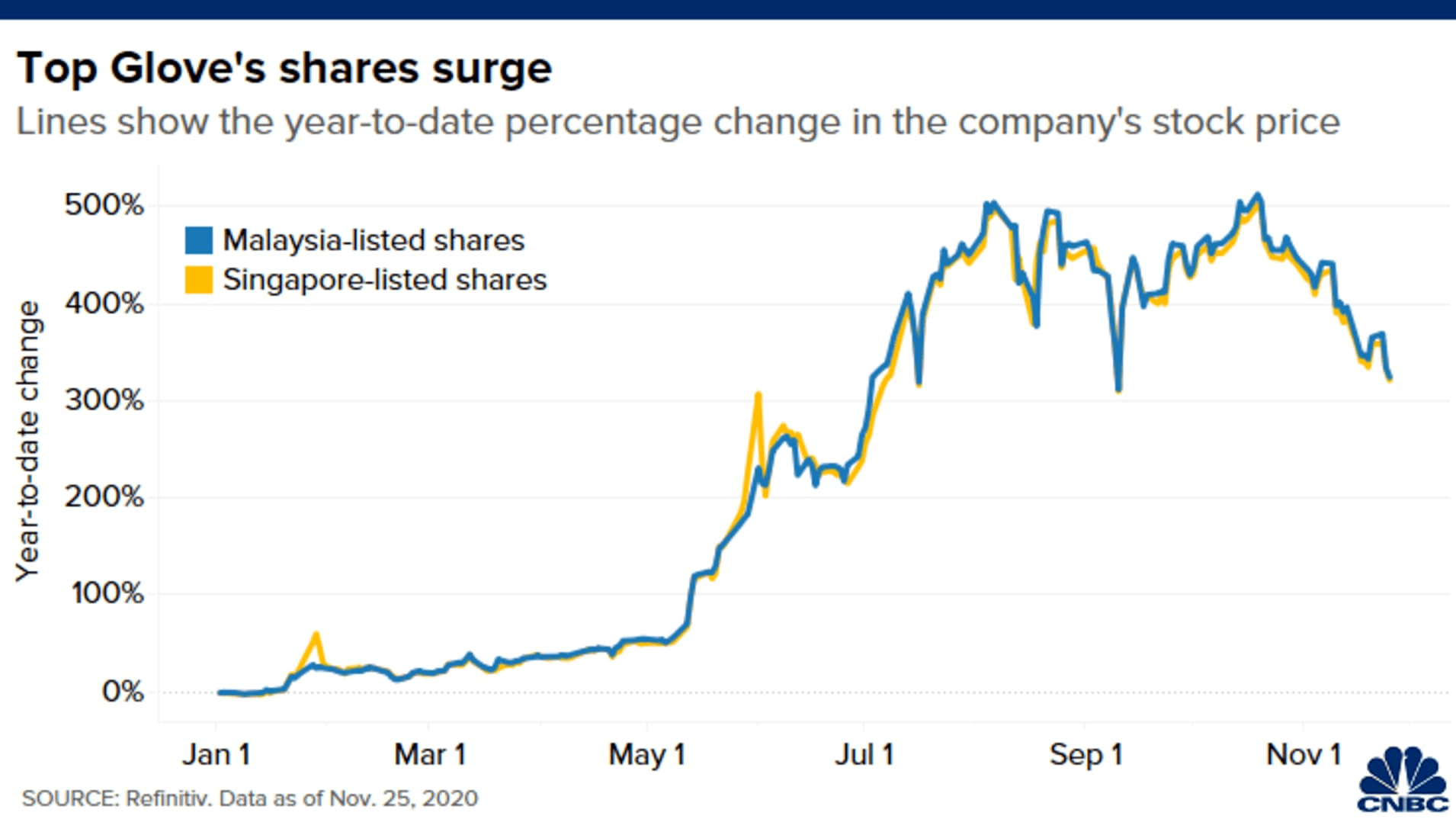

The company’s shares listed on the Malaysian stock exchange have surged by more than 255% this year as of Thursday, according to Refinitiv data. Its Singapore-listed shares experienced a similar jump of over 256%, the data showed.

A surge in demand for gloves “from virtually every country in the world” as a result of the coronavirus pandemic pushed Top Glove’s quarterly earnings to a record high, the company announced on Thursday. The coronavirus disease or Covid-19, which first emerged in China late last year, has since spread to at least 188 countries and territories globally.

Chart shows the year-to-date percentage change in the share price of Top Glove, the world's largest medical glove maker based in Malaysia.

Many analysts are bullish on the stock. Based on data compiled by Refinitiv, 18 out of 22 analysts have a “strong buy” or “buy” recommendation on Top Glove. The analysts have a median target price of 20.28 Malaysian ringgit ($4.75) for the stock — higher than Thursday’s close of 16.70 ringgit ($3.91) per share.

Ng Chi Hoong, an analyst at Malaysian investment bank Affin Hwang, raised his target price for Top Glove to 22.40 ringgit ($5.24) per share “to factor in the stronger demand outlook” while maintaining his “buy” recommendation.

“We believe that concerns that demand could fall dramatically as new COVID-19 infection cases start to fall is overly hyped, as demand from China has continued to grow despite having successfully controlled the spread of the virus,” Ng wrote in a Thursday note.

‘Extraordinary’ financial performance

Its net profit in the quarter ended May leaped 366% year over year to 347.9 million Malaysian ringgit ($81.4 million) — almost equal to the previous full-year profit of 367.5 million ringgit ($86.0 million). That came on the back of a record quarterly revenue of 1.69 billion ringgit ($395.5 million) – a gain of 413% compared to a year ago.

“The Group’s extraordinary performance was attributed to unparalleled growth in Sales Volume, on the back of the global COVID-19 pandemic,” Top Glove said in its latest financial statement.

“Monthly sales orders went up by some 180%,” it added.

But “the best is yet to come” and the company could break its quarterly record, Executive Director Lim Cheong Guan said in an online briefing, as reported by Reuters. That’s because many customers have made orders way in advance — for delivery more than a year later — “for fear of losing out,” according to the report.

Such an increase in demand has led to an increase in the average selling price of Top Glove’s products by as much as 30% since the start of this year. The company said it has added production capacity to meet that demand.

.png)

.png)

.png)

.png)

.png)